投資経験者が増加傾向に/成約顧客の年収は2つのゾーンで増加

当社は、当社の運営するネット不動産投資サービスブランド「RENOSY(リノシー)」における2023年7〜9⽉度の成約顧客動向をまとめた「RENOSY 不動産投資顧客動向レポート 2023年7〜9⽉」を発表しました。そこで、トピックスを抜粋し、お知らせします。

【RENOSY 不動産投資顧客動向レポート 2023年7〜9月 トピックス】

-

成約顧客のうち、投資経験者が増加傾向に

-

成約顧客の年収分布は、600万円台と2,000万円台で増加傾向に

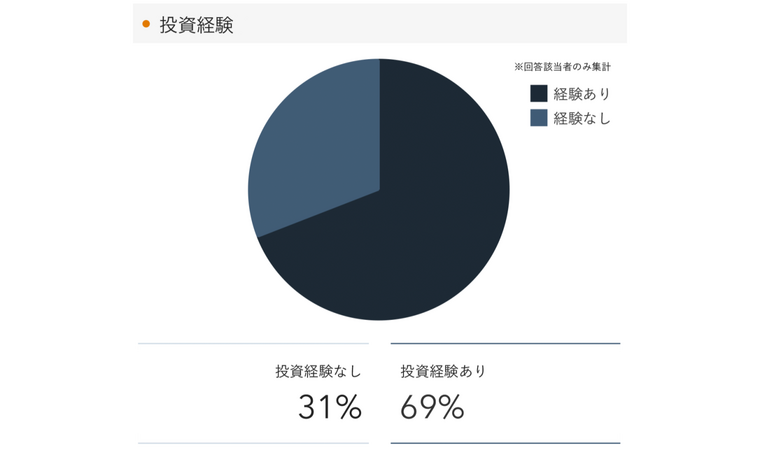

◆ 成約顧客の投資経験

2023年7〜9⽉度における成約顧客の投資経験は、成約時点で69%が「投資経験あり」となりました。

そこで、3ヶ⽉ごとの顧客動向を調査したところ、投資経験者は前年同四半期(2022年7〜9⽉)と⽐較し+5ポイント、さらにこの1年では最も数値が⾼いことが分かりました。

⾦融庁が四半期ごとに公表している「NISA・ジュニアNISA⼝座の利⽤状況に関する調査」によると(※1)、2023年6⽉末時点でのNISA(⼀般・つみたて)⼝座数は前年同時期(2022年6⽉末)と⽐較すると、約238万⼝座増加しています。

このことから証券投資の経験者増加、さらに証券投資以外の投資を⾏う⼈も増えている可能性が考えられます。

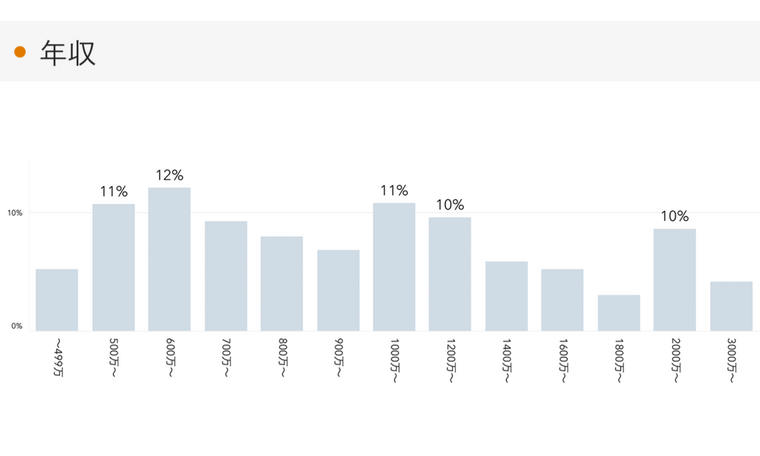

◆ 成約顧客の年収

成約顧客の年収は、最も割合の多い年収は600万円台で12%、次に多い割合が500万円台・1,000万〜1,200万円未満で11%、1,200万〜1,400万円未満と2,000万円台で10%となりました。

そこで、直近1年間における3ヶ⽉ごとの顧客動向を調査したところ、600万円台は前年同四半期(2022年7〜9⽉)と⽐較し+2ポイント、2,000万円台は前年同四半期(2022年7〜9⽉)と⽐較し+3ポイントとなり、2つの年収ゾーンで増加傾向が⾒られます。

2021年と2022年のRENOSY成約顧客動向を⽐較した「RENOSY 不動産投資アニュアルレポート2022」では、2022年度成約顧客のうち以前購⼊されている⽅の追加購⼊は31% (前年⽐+5ポイント)でした。なお、お客様の追加購⼊のきっかけは「ローン信⽤枠を最⼤限活⽤するため」という声が上がっています。

このことから、今回の調査で増加傾向にあった年収2,000万円以上の成約顧客は、ローン信⽤枠を活かし、複数件の投資⽤不動産所有を検討していると考えられます。

◆ 調査概要

調査期間:2023年7〜9⽉(3ヶ⽉ごとの顧客動向データについては、2022年7⽉〜2023年9⽉)

調査機関:RENOSY調べ

調査対象:RENOSYにおける2023年7〜9⽉度の成約数

調査⽅法:期間内の成約数を集計し、割合化

◆ ネット不動産投資サービスブランド「RENOSY(リノシー)」

RENOSYは、AIなどのテクノロジーを活⽤したネット不動産投資サービスブランドです。不動産の購⼊や売却が資産形成の⼿段としてより⾝近になるよう、不動産投資の検討から購⼊、その後の管理・売却までオンラインを中⼼としたサービスを提供しています。2023年4⽉に東京商⼯リサーチが⾏った調査では、2020年から4年連続で中古マンション投資における販売実績全国No.1を獲得(※3)しています。

ニュース一覧